Child Education & Marriage plan

Child Education plan

What is Child Education Planning?

Child education planning refers to the process of systematically saving and investing to accumulate sufficient funds for a child's higher education. With rising education costs in India and abroad, it is essential to start early and choose the right investment instruments.

Education costs in India have been increasing at an average rate of 8-10% per annum, making it crucial for parents to plan well in advance. Whether you aim for an IIT, IIM, MBBS, or foreign university degree, a structured child education plan ensures that financial constraints do not hinder your child's dreams.

How to Invest in Child Education Planning?

Investing for your child's education should be based on three key factors:

- Time Horizon - The number of years left before the child enters higher education determines the investment strategy

- Inflation Factor - Education inflation must be factored in to estimate the required corpus.

- Risk Appetite - Parents must balance between high-growth investments and low-risk instruments.

Steps to Invest in a Child Education Plan:

- Set a target corpus: Estimate the future cost of education for your child in today's terms and adjust for inflation.

- Select the right investment mix: A diversified portfolio ensures stable returns.

- Start early: The earlier you start, the more you benefit from compounding.

- Review & rebalance regularly: Investments should be monitored and adjusted as per market conditions and financial goals.

Different Types of Child Education Plans

Parents in India have multiple investment options to build an education corpus. Here are some of the best instruments:

Mutual Funds for Children Education

Mutual funds provide flexibility, liquidity, and inflation-beating returns.

- Equity Mutual Funds: Suitable for long-term goals (10+ years). SIPs in diversified funds, index funds, or ELSS provide strong growth.

- Debt Mutual Funds: Ideal for medium-term goals (3-7 years). Less volatile and offer stable returns.

- Start early: The earlier you start, the more you benefit from compounding.

- Hybrid Funds: A mix of equity and debt for a balanced approach. Provides Capital protection with equity returns.

Sukanya Samriddhi Yojana (SSY) - For the girl child

- Interest Rate: 7.5-8% (Government-backed)

- Lock-in Period: Till the girl turns 21 years

- Tax Benefit: EEE (Exempt-Exempt-Exempt) - No tax on deposits, interest, or maturity

Public Provident Fund (PPF)

- Risk-Free: Guaranteed by the Government of India

- Lock-in: 15 years (Can be used for higher education with partial withdrawal)

- Tax Benefits Exempt under Section 80C in the Old Tax Regime

Child Insurance Plans

These plans combine investment and insurance to secure a child's future.

- Provides financial protection in case of the parent's demise.

- Offers maturity benefits aligned with educational milestones.

Fixed Deposits (FDs) for Education

- Risk-Free: Guaranteed returns

- Suitable For: Short-term goals (3-5 years)

- Taxation: Interest is taxable as per the slab rates of the investor

ULIPs (Unit Linked Insurance Plans)

- Hybrid Plan:Insurance + Investment

- Tax Benefits:Under Section 80C and 10(10D)

- Lock-in: 5 years, but best for long-term planning

National Savings Certificate (NSC)

- Secure Investment:Government-backed

- Tenure:5 years

- Tax Benefits: Under Section 80C

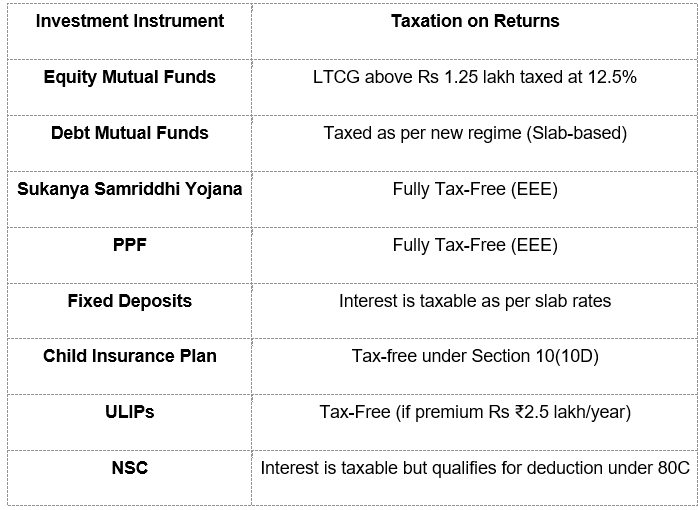

Taxation of Returns from Child Education Plans

Taxation plays a crucial role in selecting the right investment. Here's a breakdown:

Child education planning in India requires a disciplined approach and wise investment choices. By starting early and leveraging high-growth assets like mutual funds along with secure instruments like PPF and SSY, parents can create a strong financial foundation for their child's education.

Want to start your child's education planning today? Consider a mix of SIPs, government schemes, and tax-efficient investments to secure a stress-free future for your child!